Crypto price prediction: Bitcoin (BTC) now in consolidation phase, need to watch more !

Bitcoin (BTC) chart analysis:

|

| BTC chart analysis |

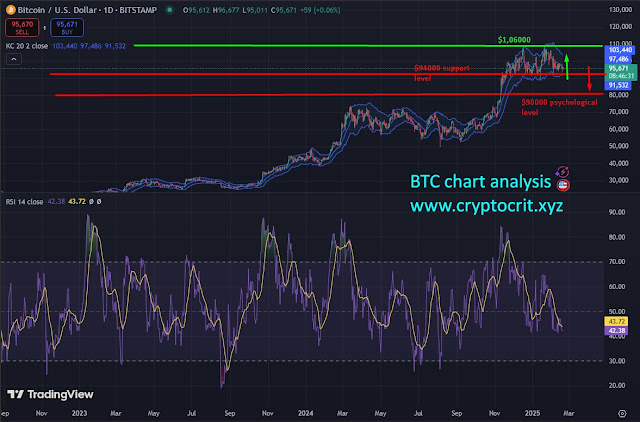

Bitcoin has been going through a period of

price consolidation after falling below the $100,000 support level on February

4. Since then, its price has been moving between $94,000 and $100,000 without a

clear direction. On Tuesday, Bitcoin dropped close to the lower boundary of

this range but found some support there. As of Wednesday, its price is hovering

around $96,300, showing no strong movement in either direction.

If Bitcoin falls below $94,000 and closes

lower, it could trigger a bigger decline. In that case, the next important

support level to watch would be $90,000. This is a psychologically significant

level, meaning many traders may see it as an opportunity to buy or sell. A drop

below this level could bring more bearish pressure, leading to further losses.

Read also:

Technical indicators also suggest uncertainty

in the market. The Relative Strength Index (RSI), which measures whether

Bitcoin is overbought or oversold, is currently at 43. This indicates slightly

bearish momentum. Last week, it tried to move above 50 (a neutral level) but

was rejected.

However, if Bitcoin manages to regain

strength and break above $100,000, it could spark a recovery. In this scenario,

the price might climb back to its previous high of $106,012, which was last

seen on January 31. A breakout above $100,000 would signal stronger buying

interest and could shift market sentiment to a more bullish outlook.

Read also:

Overall, Bitcoin remains in a consolidation

phase, with traders waiting for a breakout in either direction. A drop below

$94,000 could lead to further declines, while a move above $100,000 might bring

a fresh upward push.

Post a Comment

0 Comments