Crypto price prediction: Stellar (XLM) indicatiors have shown little recover, investors watching this level

Crypto analysis: Stellar (XLM)

Stellar Lumens (XLM) is currently priced at $0.276780, showing a decline of 2.36% in the past 24 hours. The cryptocurrency has a market capitalization of $8.27 billion, with a circulating supply of 30.79 billion tokens. The total and maximum supply of XLM is set at 50 billion tokens.

Earlier this week, Stellar found strong support at $0.24 and traded within the range of $0.27 to $0.24. For a bullish trend to take over, XLM needs to break the resistance level of $0.31. If the price holds its momentum and surpasses this key level, it could lead to a 40% price increase, potentially reaching its November 2024 high of $0.63. This makes the $0.31 resistance level a crucial point for investors to watch.

Read also:

Technical indicators suggest a recovery trend for XLM. The Relative Strength Index (RSI) currently stands at 43.58, which is below the neutral mark of 50, signaling a recovery from a bearish phase. Additionally, the Moving Average Convergence Divergence (MACD) indicator has formed a bullish crossover, further reinforcing the possibility of an upward trend. These indicators suggest that Stellar’s price might continue to rise in the near future.

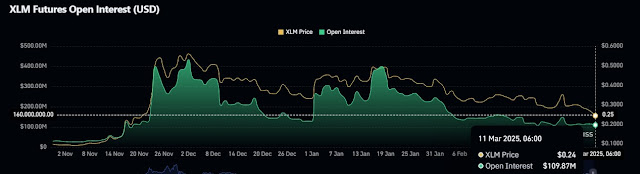

Market interest in Stellar is also growing, as shown by data from Coinglass and DefiLlama. Open Interest in XLM futures stands at $109.87 million, indicating that more traders are leaving the market by selling their holdings. Meanwhile, Stellar’s Total Value Locked (TVL) has risen from $49.24 million to $55.78 million in just 10 days, showing increased activity within its ecosystem. This rise in TVL suggests that more users are engaging with Stellar’s network, which may contribute to its future growth.

Read also:

Despite these positive signs, there is still uncertainty about the next price movement. If XLM drops below the $0.24 support level on the daily chart, it could reverse its bullish trend and fall to $0.22, aligning with its 100-day Exponential Moving Average (EMA). Investors should keep an eye on these key levels, as they will determine whether Stellar continues its upward trajectory or faces further decline.

Post a Comment

0 Comments